Wealthbox CRM integrations offer a powerful solution to streamline your daily tasks and enhance your client interactions. By leveraging CRM workflows, you can automate routine processes, ensuring nothing falls through the cracks and freeing up valuable time to focus on client needs. In this blog, we’ll explore how Wealthbox CRM integration workflows can transform your practice, seamlessly integrating with your existing software tools.

What are the Wealthbox Integration Workflows

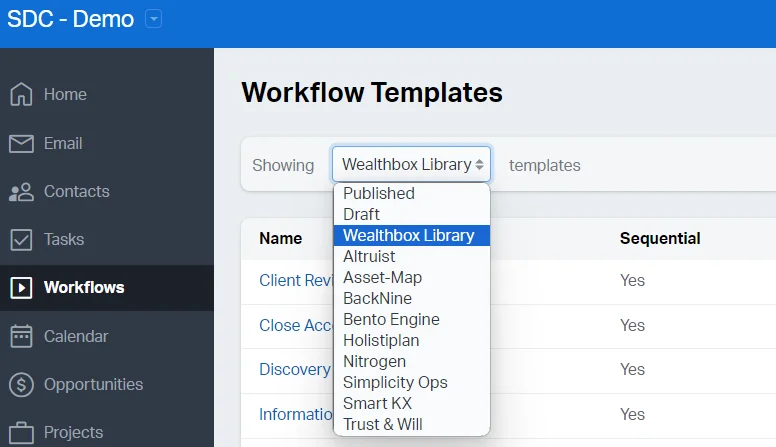

Wealthbox integration workflows enable users to automate and streamline their workflow processes for better client servicing. For instance, when meeting a new referral, you can set up an automated workflow associated with this new contact to ensure that you and your team follow up with the right actions. Wealthbox offers a comprehensive library of workflows to get you started, including Discovery Meeting Preparation, Lead Generation, New Client Onboarding, and Client Review. To use a template from the library, simply click on the duplicate button, and it will be automatically added to the drafts section of the workflow. You can then customize it by adding or deleting steps, tailoring actions, and specifying outcomes.

Besides its own library, Wealthbox partners with various integration partners to provide workflows that support advisory teams in completing tasks required by partner software. This month, Wealthbox hosted Wealthbox Workflow Week, an event where integration partners showcased their workflows and explained how they operate. During the event, I had the opportunity to present alongside Bento Engine and Trust & Will. I assisted Bento Engine in the creation of their workflow and currently support Trust & Will in implementing their workflow for their clients. These workflows are designed with advisory teams in mind, ensuring that they cater to their specific needs and processes.

The Benefits of Implementing Wealthbox Workflow Integrations

Implementing Wealthbox workflows ensures that nothing slips through the cracks by guaranteeing that each step of a process is completed according to predefined team members and timelines. These workflows enhance efficiency and accountability within your team. Let’s explore the benefits through specific examples.

Bento Engine’s Workflow

I collaborated with Philipp and his team at Bento Engine to create a workflow that launches tasks automatically when certain data points are triggered in the system. For instance, we developed the “Bento Workflow: Life in #’s – Working Papers (Age 14)” workflow to guide Advisory teams through the process when a client’s (grand)child shows interest in working, saving, and investing at the age of 14. This workflow includes up to 15 steps and assigns tasks to team members when triggered. Initial steps involve determining whether to advise on the topic and the best communication method (PPT, Email Templates, or Talking Points). Subsequent steps include securing working papers, opening a bank account, or establishing a custodial account, depending on the client’s situation. Customizable outcomes and Wealthbox’s reporting feature allow you to track key performance indicators. For example, you can generate a report summarizing how many clients’ children required working papers or custodial accounts over a year.

Trust & Will’s Workflow

Similarly, Trust & Will has developed a comprehensive workflow to ensure all steps of using their platform are completed. Samuel Deane of Deane Wealth Management, along with the Trust & Will team, meticulously outlined the necessary steps, prioritizing tasks and defining possible outcomes. I support advisory firms by helping them implement these workflows in addition to setting up the API, customizing fields, and developing reports to track these custom fields.

Other integration partners that have developed their own workflows, including prominent software platforms like Altruist, Asset Map, Back Nine, Holistiplan, and Nitrogen. These workflows streamline processes, ensuring that advisory teams can efficiently manage their tasks and provide exceptional client service.

How To Customize Your Workflows

Whether you duplicate a template from Wealthbox’s library or start from scratch, the workflows in Wealthbox are fully customizable to fit your unique needs. You can design workflows to be sequential, where steps follow a specific order, or non-sequential, where steps can occur in any order based on outcomes. Additionally, workflows can be tailored for different purposes, such as projects, contacts, or opportunities. For instance, while many workflows are designed for contacts, you can create a workflow for a project like a Client Appreciation Event to manage all the preparation and execution steps involved.

Within each workflow, steps can be detailed with a name, due date, assignee, priority, category, and description. Completing these details thoroughly enhances the effectiveness of each step. It’s advisable to assign tasks to team roles rather than individual members to ensure scalability. Adding categories helps your team understand the context of each step. For example, creating a category called “Money Movement” indicates that the step pertains to a journal or cash transaction. To customize workflows effectively, it’s best to whiteboard your processes first, ensuring that the workflows align with your specific procedures and business goals.

Enhance Your Client Servicing with Wealthbox Integration Workflows

In conclusion, Wealthbox CRM integrations and customizable workflows offer a transformative approach to client servicing in the financial industry. By automating routine tasks and ensuring that each step is meticulously followed, Advisory teams can focus more on delivering personalized and high-quality service to their clients. The flexibility of Wealthbox’s workflows allows for seamless integration with other tools and customization to fit specific business needs, making it an invaluable asset for any advisory firm.

Embracing Wealthbox integrations not only enhances efficiency and accountability but also provides the scalability needed for growing firms. With the ability to create tailored workflows for various purposes, such as contact management, projects, and opportunities, advisory teams can ensure that every process is optimized for success. By continuously refining these workflows based on insights and performance metrics, firms can maintain a competitive edge and deliver exceptional client experiences.